tax reduction strategies for high income earners australia

Structuring your business and personal assets. The ATO is far more likely to ask a lot of questions about your tax.

Prepay tax-deductible expenses to bring your tax deduction forward.

. Distribute more income to beneficiaries on lower tax brackets or. In many cases the tax savings can be tens of thousands even hundreds of thousands of dollars in a very short period of time. Tax reduction strategies for high income earners australia.

Specifically important numbers for 2022 include. Many Australian Tax Videos Are Discuss The Same BORING Strategies. While the Coalition governments seven-year Personal Income Tax Plan was originally laid out in the 2018 Federal Budget the timetable has been.

To encourage middle to high-income earners to reduce their dependability on the public health system and make the private healthcare industry more sustainable the ATO introduced a private health insurance rebate. Investing in Early Stage Investment Companies ESIC Investing in Early Stage Venture Capital Limited partnerships. Australias income tax system is undergoing a radical overhaul designed to reduce tax for the majority of individuals protect middle-income earners from bracket creep and simplify the system.

So the money was distributed to Mary. The family company also known as a holding company or bucket company is taxed at 30 so thats another 9000. The higher your tax bracket the higher the benefits are of tax savings.

The good news is that with a combination of tax deductions tax credits and contribution strategies you can reduce your tax bill by reducing your taxable income. As a refresher for 2021 fy the individual tax rates including medicare levy are. Consider salary sacrificing to reduce your taxable income.

Effective tax planning with a qualified accountanttax specialist can help you to do that. Estate and gift exemptions increasing equity exposure charitable donations health savings social security and Medicare buying municipal bonds tax loss harvesting and more. Lets start with retirement accounts.

Holding tax deductable income protection. Tax reduction strategies for high-income earners in australia. There are plenty of opportunities for high-income earners to reduce their tax burden.

Being an Australian citizen. Here are 9 ways to accomplish your goal and reduce your tax bill. I Have Dug Deeper Into Ways Middle To Upper Income Tax Payers May Reduce Tax Income Tax.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. High Income earner in Australia have the most to gain from the financial rules and investment options if they have the right advice. Tax deduction versus tax offset.

With the Medicare levy already legislated to increase from 15 to 2 from 1 July 2014 the rise in levies will effectively be 25 for. The ATO considers some expenses as valid ways to reduce tax payable however how and when the reduction is applied on the assessable income depends on the type of expense. If you are a high-income earner who is planning to sell your primary residence then you may further save on your tax on up to 500k of your capital gains.

Because she stays at home she only has to pay 13500 in taxes. The SECURE ACT includes several key changes that affect tax reduction strategies for high-income earners. Delay receiving income to avoid paying tax in the current financial year.

If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income. Tax avoidance and evasion on the other hand is illegal and attracts heavy penalties from the Australian Tax Office ATO. Investing in lower income earning spouses name may be better.

Dont waste your good fortune or hard work by not assessing if you are using the system to your advantage. 50 Best Ways to Reduce Taxes for High Income Earners. TAX REDUCTION STRATEGIES FOR HIGH-INCOME EARNERS IN AUSTRALIA.

Private Health Insurance Tax Offset. Hold investments in a discretionary family trust for tax-effective income distribution. High-income earners can take advantage of the various tax deductions or offsets that the Australian Taxation Office ATO permits.

August 12 2014. For those trying to learn how to save tax in Australia salary sacrificing is one way to do. Keep Accurate Tax and Financial Records.

A discretionary family trust can benefit high-income earners seeking to redistribute some of their income to family members in lower tax brackets. 15 Easy Ways to Reduce Your Taxable Income in Australia 1. The contribution you will make will come straight out of your.

With the budget announcement of a temporary 2 budget repair levy for taxable incomes above 180000 those who will be affected may wish to consider some planning strategies to lessen the impact. The age for Required Minimum Distributions or RMDs was raised to 72 from 70-½ in 2020 although if you turned 70-½ in 2019 you still needed to start RMDs in 2020. Because his income is so high any extra income will be taxed at the highest rate currently at 465.

Because of the way Australias income tax system is structured moving. As a general overview the most beneficial strategies for tax minimisation are. Exploring tax savings through depreciation superannuation SMSFs and capital.

The first way you can reduce your taxable income and therefore your tax on that income is through additional superannuation contributions. The other way high income earners reduce tax in Australia is by having a savvy and switched on accountant who specialises in this area. These penalties can range from fines to imprisonment for more.

So Call us on 0280625961 or Book an Appointment. This rate is lower than the lowest marginal tax rate therefore you will save tax by doing it. Make spousal contributions to reduce your tax liability.

Max Out Your Retirement Contributions. Negatively gearing a property or an investment into shares. The eligibility criteria to receive the tax offset includes.

Tax reduction strategies for high-income earners in australia. There are a couple of other options as well including carefully structuring any income-earning assets and making sure you have private health insurance so you dont have to pay the Medicare Levy Surcharge. Estate and gift exemptions increasing equity exposure charitable donations health savings social security and Medicare buying municipal bonds tax loss harvesting and more.

If you are a high-income earner it is sensible to implement tax minimisation strategies. Come in for a review at no cost and see what possible. A properly drafted discretionary trust allows trustees to distribute to the most appropriate members regarding their tax status ie.

If your total income was 88000 and you made more than 1000 in deductions you would move down to a lower tax bracket.

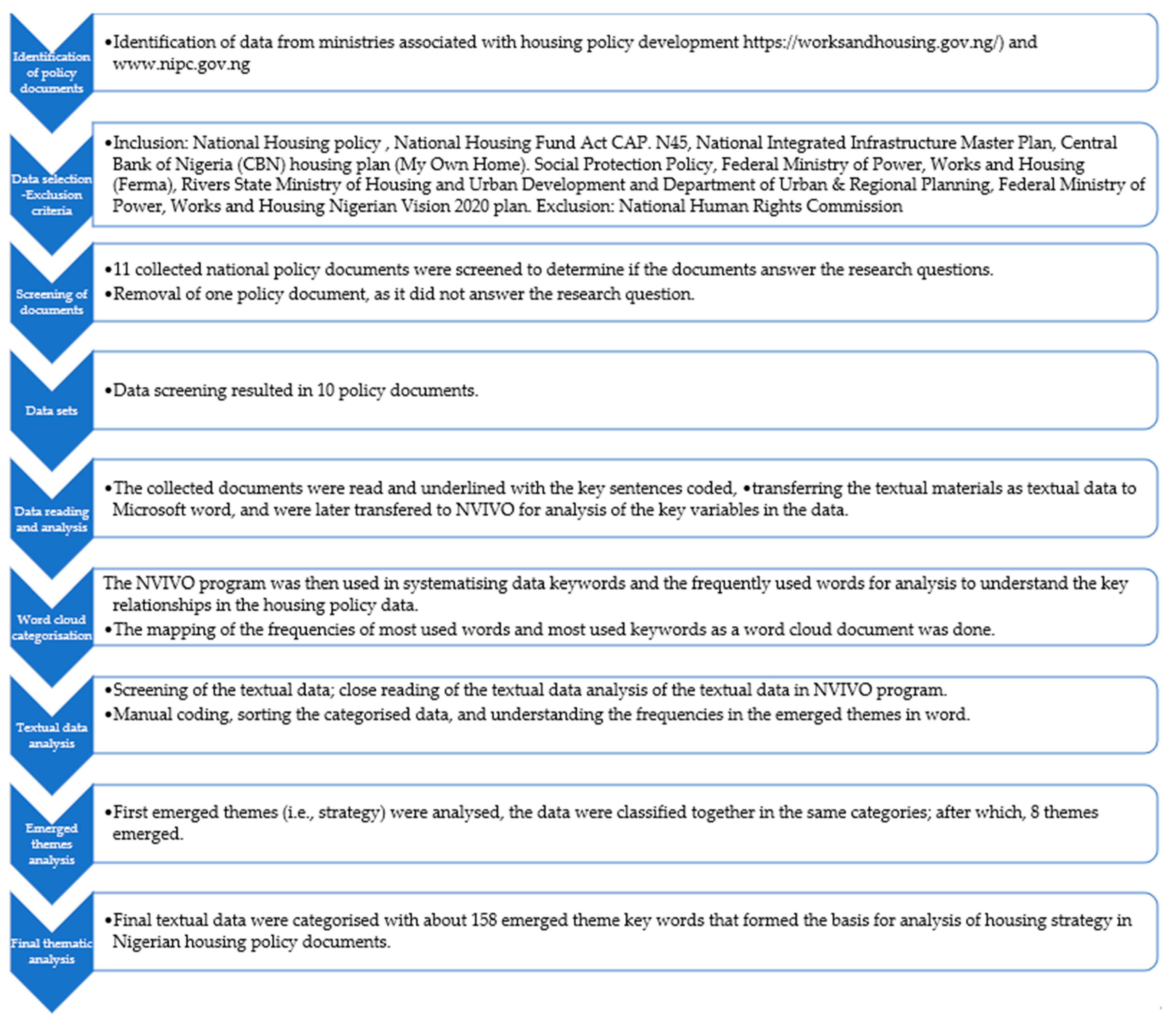

Sustainability Free Full Text Housing Policy An Analysis Of Public Housing Policy Strategies For Low Income Earners In Nigeria Html

Tax Free Wealth How To Build Massive Wealth By Permanently Lowering Your Taxes Rich Dad Advisors Wheelwright Tom Amazon De Bucher

Why It Matters In Paying Taxes Doing Business World Bank Group

Sustainability Free Full Text The Effects Of Tax Reduction And Fee Reduction Policies On The Digital Economy Html

7 Different Types Of Income Streams Penta Online Banking

How Do High Income Earners Reduce Taxes In Australia

Tax Minimisation Strategies For High Income Earners

Proposal For The Latin American And Caribbean Urban And Cities Platform By Publicaciones De La Cepal Naciones Unidas Issuu

How Do High Income Earners Reduce Taxes In Australia

Marketing Report About The Australian Company Pie Face Examining Overall Marketing Approach Grin

Marketing Report About The Australian Company Pie Face Examining Overall Marketing Approach Grin

Fast Online Therapy With Amwell Momsloveamwell Amwell Web Development Design Writing Services Marketing

Strategies And Response Options For Inclusive Development

Tax Minimisation Strategies For High Income Earners

Sustainability Free Full Text The Effects Of Tax Reduction And Fee Reduction Policies On The Digital Economy Html

Tax Policy And Inclusive Growth In Imf Working Papers Volume 2020 Issue 271 2020