jefferson parish property tax rate

Utilize our e-services to pay by e-check or credit card Visa MasterCard or Discover. 1800 Carol Sue Ave Ste.

10 Louisiana Parishes With The Highest Property Tax Rates 3 Are In Metro New Orleans

Jefferson Davis Parish collects on average -1 of a propertys assessed fair market value as property tax.

. Jefferson Parish collects on average 043 of a propertys assessed fair market value as property tax. The Audit Section is. The median property tax on a 17510000 house is 183855 in the United States.

For a 100000 home it is an estimated 20 increase per year in property taxes. Jefferson Parish Sheriffs Office. Property taxes are levied by what is known as a millage rate.

Working Hours Monday Friday. We manage the appeal forms keep track of the deadlines and submit your paperwork and evidence. Contact Info Connie Trieu.

Tax on a 200000 home. The following local sales tax rates apply in jefferson parish. The 2018 United States Supreme Court decision in.

They are maintained by various government. Jefferson Parish Property Records are real estate documents that contain information related to real property in Jefferson Parish Louisiana. Only open from December 1 2021 - January 31 2022.

One mill is one-tenth of one percent or 001. Louisiana is ranked 1929th of the 3143 counties in the United States in order of the median amount of property taxes collected. Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street Suite 1200 Gretna and is open to the public from 830 am.

Learn all about Jefferson Parish real estate tax. Teacher salaries in Jefferson Parish ranked eighth out of nine surrounding school districts in the New Orleans area. Other New Orleans-area parishes.

This gives you the assessment on the parcel. Our algorithm analyzes every single property in your neighborhood to determine how much you can save. Ad Search County Records in Your State to Find the Property Tax on Any Address.

Enter an Address to Receive a Complete Property Report with Tax Assessments More. Tax on a 200000 home. This raise which will bring the average starting salary to approximately 46000 an increase of about 5000 will vault Jefferson Parish to second-best among those same school districts.

The median property tax in Jefferson Davis Parish Louisiana is -1 per year for a home worth the median value of 2560. Jefferson Parish Assessors Office. If a Homestead Exemption HEX is in place you would then subtract 7500 75000 HEX x 10 from the assessed value to get the taxable amount.

How do I pay my Jefferson Parish property taxes. A 249 convenience fee is assessed on all credit card payments. If the parcel does not have a HEX then the assessment is.

This is the total of state and parish sales tax rates. 1 Orleans Parish. 7 Gretna LA 70056.

Audits are assigned at random upon review of taxpayer returns and upon information received from other taxing jurisdictions local state and federal. Property tax bills may be remitted via mail hand-delivery or paid online at our website. Jefferson Parish Health Unit - Metairie LDH Online Payment Pay Parish Taxes.

Located in southeast Louisiana adjacent to the city of New Orleans Jefferson Parish has a. Jefferson Davis Parish has one of the lowest median property tax rates in the country with only eighty three thousand seven hundred of the 3143 counties. The preliminary roll is subject to change.

Free jefferson parish property records search. If you are seeking certification of taxes paid for the purposes of an act of sale re-financing or to comply with other legal requirements please click the Tax Research Certificate button below to order one online or contact the Bureau of Revenue and Taxation 504 363-5710 for a tax research certificate. Jefferson parish collects on average 043 of a propertys assessed fair market value as property tax.

To find an estimate of your yearly taxes you start by multiplying the current Market Value by 10. The Jefferson Parish sales tax rate is 475. Jefferson Parish Sheriffs Office 200 Derbigny Street Suite 1200 Gretna LA 70053 Residents with questions about their property tax collection.

The minimum combined 2022 sales tax rate for Jefferson Parish Louisiana is 92. Please be advised the 2020 preliminary roll has been uploaded to the Jefferson Parish Assessor website. The Jefferson Parish Audit Section focuses on ensuring taxpayer compliance with local tax ordinances and the discovery of unreported or underreported tax revenues.

The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. Tax on a 200000 home. Estimate your Louisiana Property Taxes Use this Louisiana property tax calculator to estimate your annual property tax payment.

John the Baptist Parish. The median property tax on a 17510000 house is 75293 in Jefferson Parish. The Louisiana Constitution requires residential properties and land to be assessed at 10 of their fair market value by which the tax millage rate is applied.

The Louisiana state sales tax rate is currently 445. The median property tax on a 17510000 house is 31518 in Louisiana. You must submit your change of address in writing to the address below.

Jefferson Parish Assessors Office - Property Search. Once the preliminary roll has been approved by the Louisiana Tax Commission the 2020 assessments will be updated on the website. To 430 pm Monday through Friday.

Payne knows exactly what her money is going to now and. There is no fee for e-check payments. Whether you are already a resident or just considering moving to Jefferson Parish to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

The median property tax also known as real estate tax in Jefferson Parish is 75500 per year based on a median home value of 17510000 and a median effective property tax rate of 043 of property value. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar.

Jefferson Parish Louisiana Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Property Tax Overview Jefferson Parish Sheriff La Official Website

Jefferson Parish Voters Approve Water Sewer Taxes Westwego Picks New Mayor

Jefferson Parish Property Tax Sale

Jefferson Parish Louisiana Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Jefferson Parish Property Owners Will Pay More Taxes Soon Here S Why Local Politics Nola Com

Property Tax By County Property Tax Calculator Rethority

Jefferson Parish Voters Approve New Property Tax Increase For Sheriff S Office Pay Raises Local Elections Nola Com

Louisiana Property Tax Calculator Smartasset

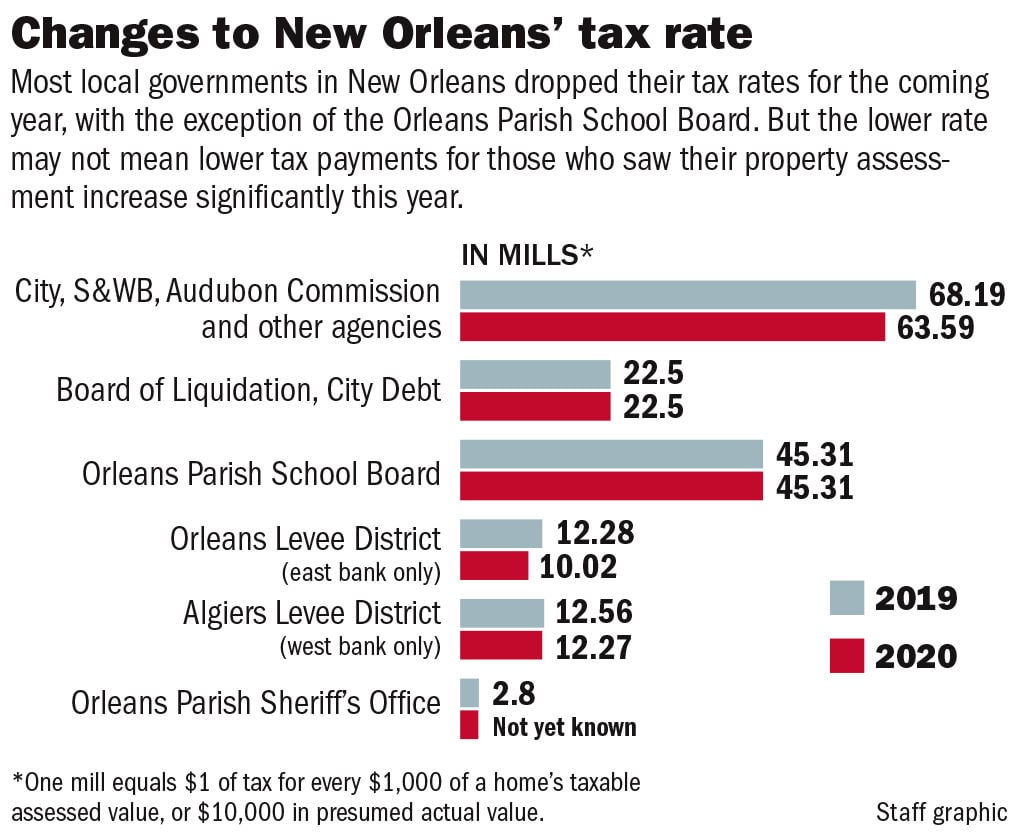

Taxes In New Orleans All But Set Property Owners Can Expect A Slight Dip In Rates Local Politics Nola Com

Jefferson Parish Sheriff Joseph Lopinto Will Seek Property Tax Increase For Employee Pay Raises Crime Police Nola Com

Jefferson Parish Sheriff S Office Jefferson Parish Sheriff S Office

Louisiana Sales Tax Rates By City County 2022

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com